A description of Dannemora’s iron ore geology by Rob Hellingwerf, Chief Geologist

Dannemora, 110 km north of Stockholm, is an iron ore mine that came into operation as early as the Middle Ages. The ore was formed 1.9 billion years ago as metal-rich deposits in coastal and lagoon-like environments together with limestone deposits.

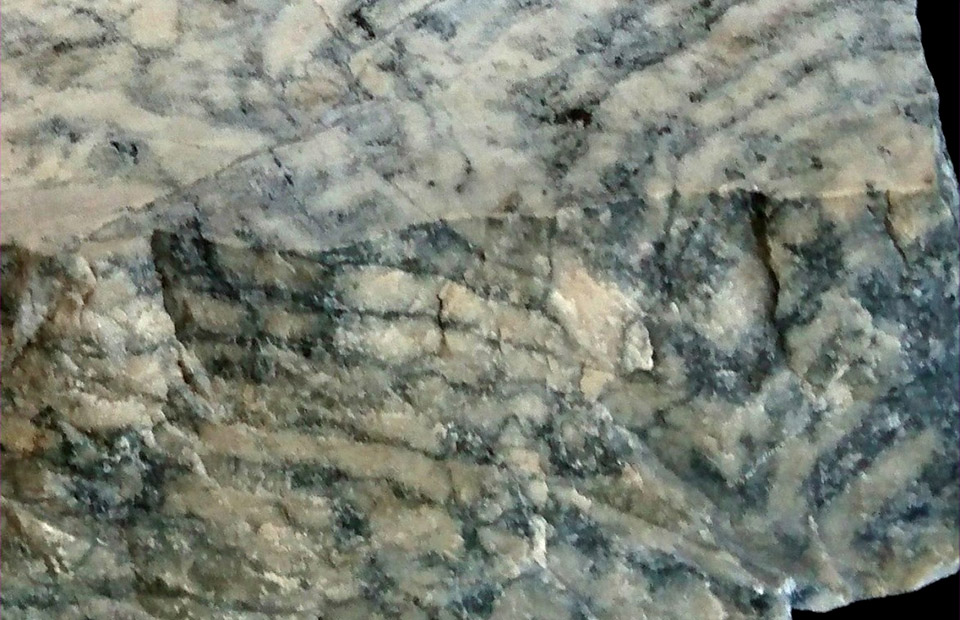

Microorganisms, now in the form of fossil stromatolites (figure 1), indicate that, even then, life existed at these latitudes, while the volcanic rocks around the ore are evidence of explosive volcanism.

Figure 1 – Stromatolites in limestone (marble). Dannemora 350 m level. Photo Rob Hellingwerf 2021. Image width 10 cm.

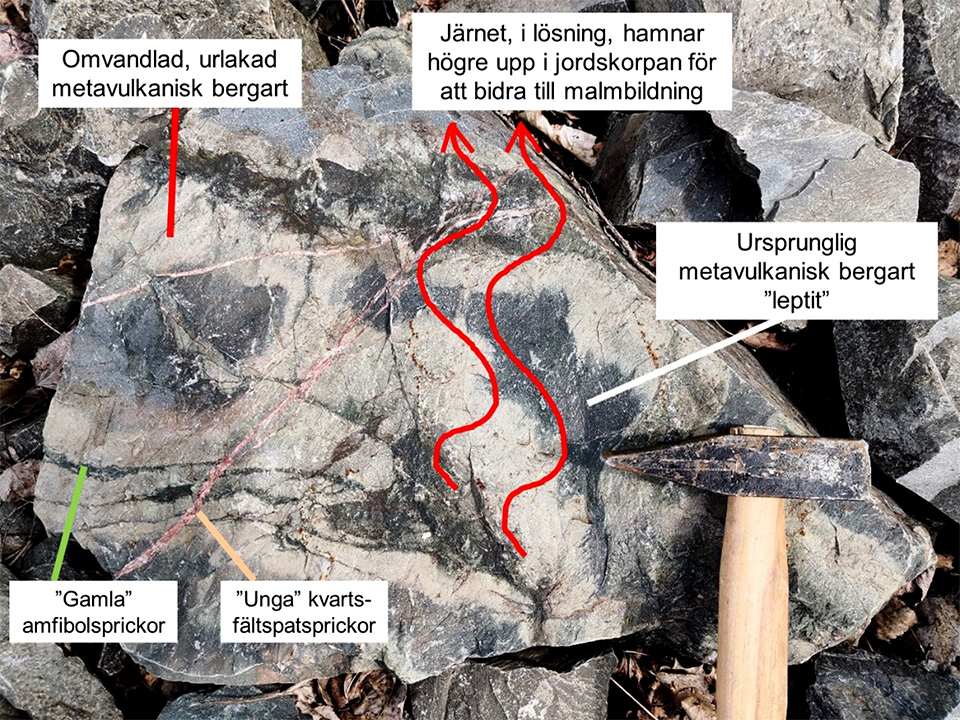

Some of the iron, at least, originates in the underlying rock formations where so-called hydrothermal solutions (warm saline aqueous solutions) leached from the iron from the bedrock. The solutions became metallic and left faded and leached rock formations behind. The textures can still be seen in the ore field (figure 2).

The hydrothermal solutions transported the iron upwards in the system until they came into contact with buffering limestone formations, where the iron precipitated as chemical sediments. Some of the limestone was then converted to a more iron-silicate-rich reaction zone (skarn). One of the many drill cores through the ore bodies demonstrates this very sequence: limestone – skarn – solid and banded magnetite (figure 3).

Figure 2: Hydrothermal conversion and leaching of original leptite leading to the development of light pores, so-called conversion zones where, among other things, iron has been leached out. Some of the iron is then transported upwards in the system to contribute to ore formation. Photo: Rob Hellingwerf 2021, Dannemora

Figure 3: DBH 3208. Sedimentary sequence with limestone (lower half, light rocks) – skarn (green shades, halfway up from the bottom of the arrow) – magnetite (black, upper 2/5 part).

Scoping Study 2021

A summary of the completed scoping study was published on 27 May, which shows good conditions for the restart of the Dannemora mine. The overall conclusion of the comprehensive study is that there are good prerequisites to restart the Dannemora mine and produce an iron ore concentrate, with 67.9% iron content – a content that is in high demand in the market. The conclusion is based on the proposals and cost calculations in the study for how a restart of the Dannemora mine can be implemented.

Golder Associates (”Golder”) was the study leader and has submitted the complete report to the company.

Highlights of the report

- An iron ore concentrate with 67.9% iron content and with low levels of impurities can be produced. The product analysis meets the high quality requirements for sponge iron production, so-called direct reduction iron (DRI).

- According to a report as of 31 December 2014, the mineral resource in the mine amounts to 25.2 Mt of known and indicated assets with 39.2% iron content, and 6.3 Mt of assumed assets. About 0.5 Mt of the known and indicated mineral resources were mined in the beginning of 2015 before the mine closed.

The possibility of extending the life of the mine has been studied, and a total of seven different areas in the mine have been identified for exploration efforts. These exploration targets (so-called assumed assets) have been estimated at between 20 and 35 Mt with between 34 and 39% iron content.

Based on the previous production in the mine until 2015, an estimate of a future production of raw ore can be made, which shows that approximately 22.69 Mt of raw ore is available from the known and indicated mineral resources. The assumed assets are not included.

The annual production rate in the mine has been calculated at 3 Mt, which would give a production of 1.1 Mt (dry) high-value iron ore concentrate.

Investments in facilities (CAPEX) are estimated at MUSD 116, up to and including the start of production. The investment estimates include 10% contingencies for the mine and 15% for the process plant. CAPEX is mainly based on budget quotes and current price lists.

In order to maintain the annual production of 3 Mt of raw ore over approximately eight years of production, the investments are estimated at MUSD 7.

The total production cost, FOB Hargs Hamn, is estimated at USD 52.3 per tonne of iron ore concentrate.

Based on the results of the scoping study and future market expectations, the conclusion is that the project should be taken to a PFS stage. The metallurgical test work carried out during the scoping study clearly shows that there is a good opportunity to increase the iron content of the concentrate, which would further improve the project’s viability and sustainability, by selling a premium product with a high demand.

Much of the work carried out as part of the scoping study is based on information and knowledge from key people who previously worked at Dannemora during the period 2012–2015.

Golder notes that large parts of the study maintain a higher level of information than is normal for an international scoping study according to JORC 2012. During the summer, work was underway to identify the parts that need to be supplemented in order to achieve a PFS status according to the JORC code, and when this was completed in August, Golder was appointed study leader to carry out the second stage in the feasibility study for the restart of the Dannemora mine. The assignment agreement with Golder Associates is an important step, and is part of the feasibility study to be able to restart the Dannemora mine – a PFS, according to the Australian standard JORC 2012.

Pre-feasibility study initiated in August 2021

The company has appointed the international consulting company Golder Associates Ireland as study leader to carry out the second stage in the feasibility study for the restart of the Dannemora mine.

The assignment agreement with Golder Associates is an important step and is part of the feasibility study to be able to restart the Dannemora mine – a so-called pre-feasibility study, according to the Australian standard JORC 2012.

“The results of the scoping study showed the real potential of the Dannemora mine. We have, for the first time, shown that it is possible to produce world-class iron ore in Dannemora, which makes the mine pertinent once again. Through this second stage in the feasibility study, we take an important step to realise our goal of becoming a future supplier, and thereby participate in the structural transformation towards sustainable steel production that is taking place in the European steel industry”, says Christer Lindqvist, CEO GRANGEX.

The study is expected to be presented during the fourth quarter of 2021.