GOVERNANCE OF THE GROUP

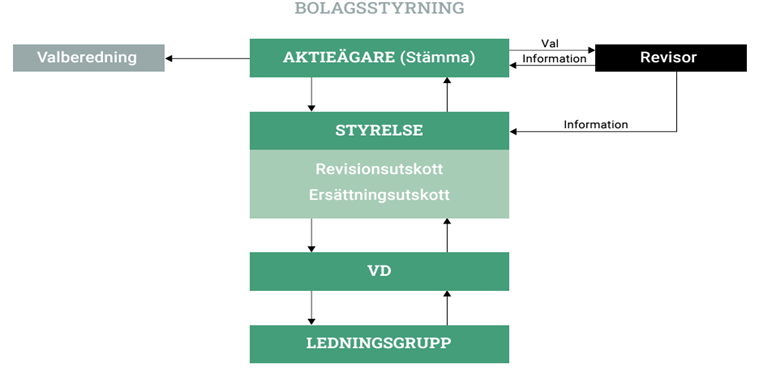

GRANGEX is subject to both external and internal governance systems. The external governance systems provide the framework for corporate governance. These include the Swedish Companies Act, the Annual Accounts Act and other applicable laws and regulations. Governance, management and control are distributed between shareholders at general meetings, the Board of Directors and the CEO in accordance with Swedish company law.

Good corporate governance aims to create the conditions for active shareholder engagement. This is achieved through a clear and well-balanced division of responsibilities between the corporate bodies, ensuring that the market is properly informed. The aim of corporate governance is to ensure that the company is managed as efficiently and effectively as possible for its stakeholders, and that GRANGEX AB (publ) (”the company” or ”GRANGEX”) complies with the rules required by legislators and regulatory authorities. Corporate governance also aims to create order and systematisation for both the Board and management. Through a clear structure and clear rules and processes, the Board can ensure that the focus of management and employees is on developing the business and thereby creating stakeholder value.

In addition to the regulatory framework, policies are applied in a number of areas, including the Group’s Code of Conduct, which all employees must be aware of and act in accordance with.

The internal control systems include the Articles of Association adopted by the General Meeting. In addition, the Board of Directors has adopted policies and instructions that clarify the division of responsibilities within the Group. Of particular importance in this context are:

■ Rules of procedure of the Management Board

■ The CEO instruction

■ Instructions for the Audit Committee

■ Instructions for the Remuneration Committee

■Reporting instructions

■ Policy for internal governance and control

■The testing scheme

Articles of Association

The articles of association are adopted by the general meeting and contain a number of mandatory details of a fundamental nature for the company. They specify the activities to be carried out by the company, the limits on the size of the share capital and the number of shares and the number of authorised directors. The articles of association do not contain any specific provisions on the appointment and removal of directors, or on the amendment of the articles of association. For the complete articles of association, please refer to www.grangex.se

Shareholders

Direct or indirect shareholdings in the company, representing at least one tenth of the voting rights of all shares in the company.

The total number of shares at the end of 2023 was 8 694 861. The number of shareholders at year-end was approximately 11 000. The largest shareholders are shown in the table on page 23. More information on the shareholder structure can be found on pages 22-23 of the annual report and on the company’s website.

Annual General Meetings

The General Meeting is the Company’s highest decision-making body. Shareholders exercise their decision-making powers by submitting proposals to, and participating and voting in, the resolutions submitted to the AGM and any extraordinary general meetings. Shareholders have the opportunity to have a matter considered at the AGM if a written request is submitted to the Board of Directors within the prescribed time. GRANGEX’s financial year runs from 1 January to 31 December. The Annual General Meeting shall be held within six months of the end of the financial year. Notice of the General Meeting shall be published in Post- och Inrikes Tidningar and on the company’s website. The fact that notice has been given shall be announced in Svenska Dagbladet.

Notice of an Annual General Meeting and of an Extraordinary General Meeting at which an amendment to the Articles of Association will be considered shall be given not earlier than six weeks and not later than four weeks before the meeting.

Notice of any other extraordinary general meeting must be issued no earlier than six weeks and no later than two weeks before the meeting. The rules governing the annual general meeting and what must take place at it are set out in the Companies Act and the articles of association. The AGM elects Board members, adopts the income statement and balance sheet, decides on the appropriation of profits and discharge from liability for the members of the Board and the company’s CEO, sets fees for the Board and the auditor and the terms of remuneration for the Board and the auditor.

the senior management of the company. The General Meeting authorises the Board of Directors to take decisions on matters that do not relate to day-to-day operations.

All shares in GRANGEX AB (publ) have equal voting rights with one vote per share.

All shareholders who are entered in the share register and who have notified the company of their attendance within the time limit laid down in the notice of meeting are entitled to attend the company’s meetings and vote their shares. Shareholders may also be represented by proxy at the meeting. The Company is governed by the General Meeting, the Board of Directors and the Managing Director in accordance with the rules and regulations laid down by law or other statute.

Annual General Meeting on 16 May 2023

The Annual General Meeting was held on 16 May 2023 in Stockholm. The following decisions were taken at the meeting:

■ the income statements and balance sheets of the parent company and the group for the financial year 2022 were adopted.

■ that no dividend would be paid.

The members of the Board of Directors and the Managing Director were discharged from liability for the financial year.

to appoint the registered auditing firm Öhrlings Price water house Coopers AB with the authorised public accountant Anna Rozhdestvenskaya as principal auditor for the period until the end of the Annual General Meeting 2024.

■ that the Management Board shall consist of six full members with no alternates.

■ to authorise the Board of Directors to issue new shares or other financial instruments on one or more occasions until the next Annual General Meeting.

in accordance with the Nomination Committee’s proposal, that remuneration to the members of the Board of Directors shall be paid in the amount of SEK 400,000 to the Chairman and SEK 250,000 to each of the other members elected by the General Meeting who are not employed by the company. In addition, remuneration totalling not more than SEK 600,000 may be paid for work performed by a member of the Board of Directors for the company in addition to what may be considered attributable to the Board assignment.

to authorise the Board of Directors, in accordance with the Board’s proposal, to resolve, with or without deviation from the shareholders’ preferential rights, on one or more occasions during the period until the end of the next Annual General Meeting, to issue shares and/or warrants and/or convertible bonds against consideration in the form of cash payment, contribution in kind or by way of set-off of existing claims on the company. New issues of shares and/or warrants and/or convertible bonds under the authorisation may in total comprise a maximum number of shares which, on a fully diluted basis and taking into account such shares that may be subscribed for through the issue of warrants and/or convertible bonds, is within the limits of the Articles of Association applicable from time to time.

■ to amend the Articles of Association, as proposed by the Board of Directors, as follows

• to change the company name to GRANGEX AB (publ)

• that the place of the General Meeting shall be where the Board of Directors has its registered office or in Östhammar municipality or Ludvika municipality

• that the Board shall consist of 4-9 members without alternates

• To attend a general meeting, shareholders must register with the company by the date specified in the notice of meeting. This day may not be a Sunday, other public holiday, Saturday, Midsummer’s Eve, Christmas Eve or New Year’s Eve and may not fall earlier than the fifth weekday before the meeting. Proxies need not notify the number of assistants. The number of assistants may not exceed two.

• The Board of Directors may collect proxies in accordance with the procedure set out in Chapter 7. 4, second paragraph of the Companies Act (2005:551). The Board of Directors may, prior to a General Meeting, decide that the shareholders shall be able to exercise their voting rights by post before the General Meeting in accordance with the procedure set out in Chapter 7 Section 4a of the Swedish Companies Act (2005:551). The Board of Directors may decide that a person who is not a shareholder in the company shall, under the conditions determined by the Board of Directors, be entitled to attend or otherwise follow the proceedings of the General Meeting.

The minutes of the 2023 General Assembly are available at www.grangex.se

Extraordinary General Meeting on 19 December 2023

The Extraordinary General Meeting was held on 19 December 2023 in Stockholm. The following resolutions were adopted at the meeting:

to amend the Articles of Association, as proposed by the Board of Directors, so that the Board of Directors shall consist of 3-7 members without deputies

■ that the Board of Directors shall consist of six ordinary members without deputies for the period until the end of the next Annual General Meeting in 2024 that the Board of Directors shall appoint from among its members the Chairman and Vice-Chairman (if applicable) of the Board of Directors following the election of a new Board of Directors by the General Meeting, all in accordance with the proposal of the Board of Directors

■ that remuneration for additional committee work or work that a Board member performs for the company, in addition to what can be considered attributable to the Board assignment, shall amount to a total of SEK 1,200,000. Board members who are also employed by the company or its subsidiaries shall not receive remuneration for board work. The level of remuneration shall relate to the entire period from the previous Annual General Meeting of the Company up to and including the next Annual General Meeting of the Company, in accordance with the proposal submitted by the shareholders Christer Lindqvist and his wholly owned company JRS Asset Management AB

■ re-election of Annika Billberg and Klas Åström and to elect Bård Bergfald, Tobias Fagerlund, Johan Lundqvist and Thomas Söderqvist as ordinary members of the Board of Directors of the company for the period until the end of the next Annual General Meeting. It was noted that the Board of Directors thus consists of Bård Bergfald, Annika Billberg, Tobias Fagerlund, Johan Lundqvist, Thomas Söderqvist and Klas Åström.

The minutes of the Extraordinary General Meeting in December 2023 are available at www.grangex.se

The Nomination Committee

The Nomination Committee represents the shareholders. The task of the Nomination Committee is to prepare and present proposals to the AGM regarding the number and election of Board members, the Chairman of the Board, the remuneration of the Board and its committees, the election and remuneration of the auditors and, if necessary, the process and criteria that should govern the appointment of the members of the Nomination Committee. The focus of the Nomination Committee’s work is to ensure that the Board is composed of members who together possess the knowledge and experience that meet the requirements that the owners place on the company’s highest governing body. In the process of preparing proposals for Board members, the Chairman of the Board therefore presents the evaluation made of the Board’s work and of the individual members during the past year. Furthermore, the CEO presents the company’s activities and future direction and the Nomination Committee is given the opportunity to meet some of the Board members.

The Nomination Committee also prepares, with the support of the Audit Committee, the election of auditors. Shareholders can submit proposals to the Nomination Committee in accordance with the instructions available on the company’s website. The AGM decides on the principles for the appointment and work of the Nomination Committee.

According to previous AGM resolutions, the company shall have a Nomination Committee consisting of four members – the Chairman of the Board and representatives of the three largest shareholders. The Chairman of the Board shall, based on ownership statistics from Euroclear Sweden AB on 30 September of the current financial year, gather the three largest shareholders to appoint a nomination committee. If any of the three largest shareholders chooses to waive its right to appoint a member of the Nomination Committee, or is otherwise deemed to have waived such right, the right to appoint a representative to the Nomination Committee shall be transferred to the shareholder who subsequently has the largest shareholding in the company in terms of votes. The composition of the Nomination Committee shall be announced no later than in connection with the interim report for the third quarter of the current financial year. The Chairman of the Board shall not be the Chairman of the Nomination Committee. The Nomination Committee shall appoint a Chairman from among its members.

The task of the Nomination Committee is to submit proposals to the Annual General Meeting for the next financial year on the number of Board members, the composition and remuneration of the Board and any special remuneration for committee work. Furthermore, the Nomination Committee shall submit proposals on the Chairman of the Board and the Chairman of the Annual General Meeting and on auditors and their remuneration. The term of office of the Nomination Committee is until a new Nomination Committee is appointed. If a member leaves the Nomination Committee before its work is completed or if there is a significant change in the ownership structure after the Nomination Committee has been constituted, a replacement shall be appointed in accordance with the procedure by which the resigning member was appointed. Changes in the composition of the Nomination Committee shall be published on the company’s website. The Nomination Committee’s proposals shall, if possible, be published in connection with the notice of the Annual General Meeting.

The Board of Directors

The Board of Directors is appointed by the owners to be ultimately responsible for the organisation of the company and the management of the company’s affairs in the best interests of both the company and the shareholders. This must be done in a sustainable manner with a well-balanced risk-taking to ensure long-term positive development. The Board is responsible for the company’s organisation and strategy and appoints the CEO. The Board sets the company’s financial targets, ensures that there are effective systems for monitoring operations and internal control, that laws and regulations are complied with, and ensures accurate and transparent disclosure of information.

At the statutory Board meeting immediately following the Annual General Meeting, the Board of Directors adopts rules of procedure which set out in greater detail its work and responsibilities and the specific tasks of the Chairman of the Board. According to the Articles of Association, the Board shall consist of a minimum of three and a maximum of seven members without deputies elected by the AGM. The Extraordinary General Meeting of 2023 decided that the Board should consist of six members elected for one year at a time. The Extraordinary General Meeting of 19 December 2023 decided that the Board of Directors shall appoint from among its members the Chairman of the Board. It was noted that the Board of Directors, for the period until the end of the 2024 Annual General Meeting, thus consists of Bård Bergfald, Annika Billberg, Tobias Fagerlund, Johan Lundqvist, Thomas Söderqvist and Klas Åström.

At the end of 2023, 17 per cent of the Board members elected by the General Meeting were women. The ambition is to strive for gender balance and an otherwise appropriate and favourable composition that meets the company’s needs.

The Group’s legal adviser is the Secretary to the Board. Board meetings are normally attended by the CEO and the CFO from management. Other members of the company’s management and other officials act as rapporteurs on specific matters. The members elected by the AGM are all independent in relation to both major shareholders and the company and its management. The members are presented on pages 44-45 and on the company’s website.

The Chair leads the work of the Board and ensures an open and constructive dialogue. The Chairperson’s tasks also include monitoring and evaluating the competence, work and contribution of individual members to the Board. The Chairperson of the Board leads the work of the Board and ensures that the Board fulfils its tasks and has a particular responsibility for ensuring that the work of the Board is well organised, carried out efficiently and follows the development of the business. The Chairman ensures that the Board’s decisions are implemented effectively. An important part of the Chairman’s work is to act as a discussion partner and support for the CEO and to ensure that the Board’s decisions, instructions and directions are implemented and complied with. Prior to each Board meeting, the Chairman and the CEO go through the issues to be addressed at the meeting. Documents for the Board’s consideration of matters are sent to the members one week before the Board meeting. The detailed division of labour between the Board and the Executive Director is set out in instructions to the Executive Director adopted by the Board at its inaugural meeting.

The Board of Directors annually reviews and adopts rules of procedure for its own work. The Board also adopts instructions for the Executive Director and instructions for financial reporting.

The Board’s annual programme

February

■ Annual accounts for the previous year and year-end report

■Evaluation of the Board’s work

Matters related to the Annual General Meeting Constitutive Board meeting in connection with the Annual General Meeting

■Signature

■ Revision of the rules of procedure, CEO instructions and instructions on financial reporting

May

■Review of organisation and staff development

■Interim report, first quarter

■Forecast 1

August

■Half-yearly report

■Review of business areas

■Forecast 2

Strategy meeting in October (incl. management team), (2 days)

■Long-term strategy and development issues

■Budget Directive

The work of the Board in 2023

In 2023, the Board held 24 meetings, including two statutory meetings. The Board receives regular information on the company’s and the Group’s financial situation and also developments in the area of sustainability. Each Board meeting begins with a review of the business, covering a number of areas. These usually provide an update on project development, production and financial performance, any challenges or risks that have been identified or are subject to ongoing reporting, and projects and investments. Given the nature of the business, sustainability issues are particularly important. Some areas, which are particularly topical or material, are subject to in-depth analyses to enable better informed decisions. The Board of Directors receives in-depth presentations of the main risks and certain risks in areas such as the environment and sustainability.

Board committees

The overall responsibility of the Board cannot be delegated. However, the Board can set up committees within itself to prepare matters in defined areas. At the statutory meeting following the Extraordinary General Meeting in December 2023, the Board established an Audit Committee and a Remuneration Committee. The members of the committees are appointed at the statutory Board meeting following the AGM and their work is governed by the committees’ rules of procedure and instructions.

Audit Committee

Since the inaugural meeting in December 2023, the company has had an Audit Committee consisting of Klas Åström (Chairman) and Johan Lundqvist. The Audit Committee prepares certain issues for the Board’s decisions and in this way supports the Board in its work to fulfil its responsibilities in the areas of internal control and accounting and to ensure the quality of financial reporting. The Audit Committee shall, without prejudice to the Board’s responsibilities and tasks in general, meet the company’s auditors on an ongoing basis to inform itself about the focus and scope of the audit. The Committee also monitors the procurement of non-audit services from the company’s auditors, as well as procuring audits and, if necessary, submitting proposals to the Nomination Committee regarding the election of auditors. The Committee meets prior to each reporting date and in addition as required, at least twice a year in total. The meetings shall be minuted. The members of the Committee have particular expertise, experience and interest in financial and accounting matters, see the Board’s remit and previous experience on pages 44-45. The meetings are also attended by the Group CFO. The Audit Committee reports regularly to the Board on the results of its work

Remuneration Committee

Since the statutory meeting in December 2023, the company has had a remuneration committee consisting of Klas Åström (chairman) and Tobias Fagerlund. The main task of the Remuneration Committee is to prepare the Board’s decisions on matters relating to remuneration principles, remuneration and other terms of employment for management, to monitor and evaluate ongoing programmes for variable remuneration for management and those concluded during the year, and to monitor and evaluate the application of the guidelines for remuneration to senior executives adopted by the AGM, as well as the current remuneration structures and remuneration levels in the Group. The application of the guidelines and the applicable remuneration structures and levels is also monitored by the Committee. An account of the remuneration of the company’s management is provided in Note 4. The Remuneration Committee reports on its work to the Board of Directors.

CEO and Group Management

The Chief Executive Officer (CEO) is appointed by the Board of Directors and manages the organisation in accordance with the instructions adopted by the Board. The CEO is responsible for the day-to-day management of the Company’s and the Group’s operations in accordance with the Swedish Companies Act and has ultimate responsibility for ensuring that the strategic direction and the Board’s decisions are implemented and complied with, and that risk management, governance, systems, organisation and processes are satisfactory. The CEO continuously keeps the Board and the Chairman informed about the financial position and performance of the Company and the Group. In his work, the CEO is supported by the Group’s management team which, in addition to the CEO, consists of the managers in Dannemora and Sala, and the CFO. The management team meets regularly to monitor operations and discuss Group-wide issues, and to prepare proposals for the strategic plan, business plan and budget, which the CEO then submits to the Board. The areas addressed by the Board have largely reflected the work of management during the year. For major projects, specific steering groups are set up and meet regularly with project managers and other stakeholders. A presentation of the management team can be found on pages 46-47.

Business management

Governance from the Board of Directors is channelled through the CEO and the Management Team to the operational units. Within the organisation, responsibility and authority are delegated within a clear framework. These frameworks are defined by the company’s governing documents, budget and strategic plan.

Governance of the sustainability programme

GRANGEX’s sustainability work is driven by the issues that are most important to the business. Sustainability issues are followed up and discussed at management team and board meetings. The company has identified a number of sustainability issues and these are integrated into the sustainability strategy and described on pages 24-34. Each sustainability issue has a long-term focus that will help to guide and structure the work at all levels of the Group. Factors that form the basis for prioritisation are the impact of operations on people, the environment and society, expectations from internal and external stakeholders, risks and opportunities, external factors and applicable regulations. GRANGEX sees the UN Sustainable Development Goals as an important basis for its work. Sustainability issues are monitored through, among other things, participation in the national industry organisation SveMin. Sustainability work is value-based, which means that measures are not decided solely on the basis of laws and regulatory requirements, but also on the basis of identified needs and improvement measures that can improve the situation for people, the environment and society at the operating centres. To further integrate GRANGEX’s sustainability commitments and to ensure transparency and accountability around sustainability, a Head of Sustainability was recruited in 2023.

Auditors

The external auditor is an independent reviewer of the accounts to ensure that they present fairly, accurately and completely, in all material respects, the financial position and results of the Company. The auditor also reviews the day-to-day management of the Board of Directors and the Managing Director and reports its findings to the Board without the presence of management. The auditor liaises with the company’s management in connection with the audit or any issues that arise. The auditors report to the owners at the Annual General Meeting through the audit report. Since the formation of the Audit Committee, the auditor regularly attends the Audit Committee meetings and also meets the Board on various occasions during the year. The auditor reports to the shareholders at the AGM. At the 2023 AGM, the audit firm Öhrlings PricewaterhouseCoopers AB (”PwC”) was elected as auditors until the end of the 2024 AGM. Authorised Public Accountant Anna Rozhdestvenskaya is the auditor in charge. The remuneration of the auditors is based on approved invoices. Information on the remuneration is provided in Note 3.

Financial reporting

The Board of Directors is responsible for ensuring that the company’s organisation is designed so that the company’s financial circumstances can be controlled in a satisfactory manner and that financial reports, such as interim reports and annual accounts to the market, are prepared in accordance with the law, applicable accounting standards and other requirements that exist for listed companies. The Board of Directors shall monitor financial developments, ensure the quality of financial reporting and internal control, and regularly monitor and evaluate operations. The Audit Committee is responsible for preparing the Board’s work on quality assurance of the company’s financial reporting. However, the Audit Committee deals not only with the Group’s financial reports and more significant accounting issues, but also with issues such as internal control, compliance, material uncertainty in recognised values, events after the balance sheet date, changes in estimates and assessments, and other circumstances that affect the quality of the financial reports. The CEO must ensure that the company’s accounting is carried out in accordance with the law and that assets are managed in a satisfactory manner. The CEO and CFO of GRANGEX are members of the boards of all subsidiaries. Financial reporting to the Board of Directors and management is done monthly according to an established schedule in accordance with applicable laws, regulations and accounting practices and the Group’s financial manual.

Further information

The company’s website www.grangex.se contains the following information:

Articles of Association

Information from previous Annual General Meetings

Board and management

INTERNAL CONTROL OVER FINANCIAL REPORTING

GRANGEX has a governance and internal control framework which aims to provide the necessary conditions for the entire organisation to contribute to efficiency and high quality in corporate governance, through, among other things, clear definitions, designation of roles and responsibilities, as well as group-wide tools and procedures.

GRANGEX’s internal control over financial reporting is based on the framework issued by the Committee of Sponsoring Organisations of the Treadway Commission (COSO framework). The key objectives of GRANGEX’s internal control environment for financial reporting are that it is effective and efficient, provides reliable reports and complies with laws and regulations.

The internal control process

The internal governance and control process is governed by laws and regulations and the ultimate responsibility lies with the Board of Directors. The systems of internal control and risk management over financial reporting are designed to provide reasonable assurance regarding the reliability of external financial reporting and to ensure that the financial statements are prepared in accordance with generally accepted accounting principles, applicable laws and regulations and other requirements for listed companies. The internal control process consists of the following components:

■ Control environment

■ Risk assessment

■ Control activities

Information and communication

■ Follow-up

The Board of Directors has defined policies regarding processes, roles and responsibilities that are critical to financial reporting and to the internal control environment of the Group.

Roles and responsibilities

The Board of Directors is responsible for establishing key rules and guidelines for internal control. The Audit Committee assists the Board in its oversight of the Group’s risk management function and internal controls insofar as they affect the quality and independence of financial reporting. The Board and the Audit Committee interact directly with the external auditors. The Board is responsible for setting the basic rules and guidelines and the CEO is responsible for the effective design, implementation and monitoring of the internal control environment within the Group. The CEO is responsible for the effective design and implementation of internal control within the group. The CFO is responsible for the effective design and operational effectiveness of the internal control environment at group level.

Control environment

The control environment forms the basis of the Company’s internal control over financial reporting. Internal control is mainly based on the corporate culture and values established by the Board of Directors and management, as well as the organisational structure with clear powers and responsibilities. To ensure a common view and approach, there are governing documents in the form of binding policies and indicative guidelines for the organisation’s delegated responsibilities.

Policies and instructions are documented and evaluated continuously. These policy documents as well as elaborated process descriptions are made available to relevant staff.

Risk assessment

The risk assessment includes processes for identifying, analysing and evaluating risks in financial reporting. This step involves assessing and prioritising the areas that each business area considers most relevant to the company based on a risk analysis. The risk analysis considers both the likelihood and the consequence of a risk materialising. Risk analyses are performed regularly at Group level to identify and understand the risks in the Group, both in terms of materiality and complexity. The risk analysis is then used as a basis for determining the areas to be prioritised and how the risks within them are to be limited and managed.

Control activities

Control activities are activities aimed at limiting risks and ensuring the reliability of the company’s organisation. The primary purpose of control activities, which may be manual or automated, is to manage known risks and to detect, prevent and correct errors and misstatements, thereby ensuring the quality of financial reporting. They include policies and procedures that help to ensure that management directives are complied with and that the necessary actions are taken to highlight the risks that may prevent the company from achieving its objectives. Authorisation instructions, payment instructions, verifications, reconciliations, business reviews as well as segregation of duties are examples of control activities.

Control activities are implemented throughout the organisation, at all levels and in all functions. Control activities are embedded in GRANGEX business processes and play a key role in ensuring effective internal control in the Group. The Group CFO is responsible for ensuring that all control activities are implemented and maintained at central level.

Continuous reviews are performed to ensure accurate and correct financial reporting. These reviews are an important part of GRANGEX business processes and an important part of the Group’s monitoring controls. Each identified risk is covered by one or more controls.

Information and communication Information and communication is both an internal tool to strengthen the internal control environment and a process to ensure that accurate information is identified, collected and communicated. This is done in a way and within a timeframe that enables the organisation to perform its tasks. Within the Group, policies and instructions have been adopted and the company’s financial handbook contains instructions and advice for accounting and financial reporting. Policies, instructions and the financial handbook are continuously updated and are available to the entire organisation. Furthermore, the Board receives additional information regarding risk management, internal control and financial reporting via the Audit Committee. A communication policy is in place to ensure that external information is accurate and complete.

Follow-up

Monitoring takes place at all levels within the Group. The company regularly evaluates the internal control over financial reporting. The work on internal control is reported to the Board through the Audit Committee. This reporting forms the basis for the Board’s evaluation and assessment of the effectiveness of internal control over financial reporting and forms the basis for decisions on any improvement measures. Identified areas for improvement are documented, analysed and remedied.

share capital shall be a minimum of SEK 30,000,000 and a maximum of SEK 120,000,000.

§6 NUMBER OF SHARES The number of shares shall be a minimum of 8,000,000 and a maximum of 32,000,000.

§7 FINANCIAL YEAR The company’s financial year shall be the calendar year.

§8 BOARD OF DIRECTORS The Board of Directors shall consist of 3 – 7 members without deputies.

§9 AUDITOR The company shall appoint 1–2 regular auditors with or without deputies.

§10 NOTICE OF GENERAL MEETING Notice of the General Meeting shall be given through publication in the Post and Internal Gazette and on the company’s website. The notice of the meeting shall be announced in Svenska Dagbladet. Notice of the Annual General Meeting and notice of an Extraordinary General Meeting where amendments to the Articles of Association will be addressed shall be issued no earlier than six weeks and no later than four weeks before the meeting.

DocuSign Envelope ID: C1DED4B4-53D1-4725-9F91-1AC610B4FB08

Notice of another Extraordinary General Meeting shall be issued no earlier than six weeks and no later than two weeks before the meeting.

§11 SHAREHOLDERS The shareholder or custodian entered in the share register on the record date and recorded in a record of shareholders according to Chapter 4 of the law {1998:1479) on the registration of financial instruments or the one recorded on a record date account according to Chapter 4, Section 18, first paragraph 6 – 8 of the mentioned law, shall be deemed eligible to exercise the rights under Chapter 4, Section 39 of the Companies Act (2005:551).

§12 PARTICIPATION IN THE GENERAL MEETING To participate in the General Meeting, shareholders must notify the company by the date specified in the notice until the meeting. This day must not be a Sunday, other public holiday, Saturday, Midsummer Eve, Christmas Eve, or New Year’s Eve and not occur earlier than the fifth working day before the meeting. Proxy holders do not need to report the number of assistants. The number of assistants may not exceed two.

§13 POWER OF ATTORNEY COLLECTION, POSTAL VOTING, ETC. The Board of Directors may collect proxies according to the procedure specified in Chapter 7, Section 4, second paragraph of the Companies Act (2005:551). The Board of Directors may, before a General Meeting, decide that shareholders may exercise their voting rights by mail before the General Meeting according to the procedure specified in Chapter 7, Section 4a of the Companies Act (2005:551). The Board of Directors may decide that those who are not shareholders in the company shall, on the conditions determined by the Board, have the right to attend or otherwise follow the proceedings at the General Meeting.

Board of Directors

The company’s Board of Directors consists of five members. The Board of Directors’ work is led by Chair Per Berglund. Per Bergman, Jesper Alm, Lars Ransgart and Christer Lindqvist are members.

The Board of Directors is elected at the Annual General Meeting for the period until the following Annual General Meeting. The Board of Directors is responsible for the company’s organisation and management. At the statutory Board meeting that follows immediately after the Annual General Meeting, the Board of Directors adopts rules of procedure that further regulate the work and responsibilities that rest with the Chair of the Board. The Chair of the Board leads the work of the Board of Directors, and monitors operations through continuous dialogue with the CEO, who handles the ongoing administration. The division of work between the Board of Directors and the CEO is stated in the CEO’s instructions, which are approved at the statutory Board meeting.

Each year, the Board of Directors shall hold at least six meetings, one statutory and five regular board meetings. The regular meetings shall deal with the CEO’s report on operations and interim reporting.